Marginal Tax Rates 2025 Australia. From 1 january 2025, we have used the exchange rates from the reserve bank of australia. The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year.

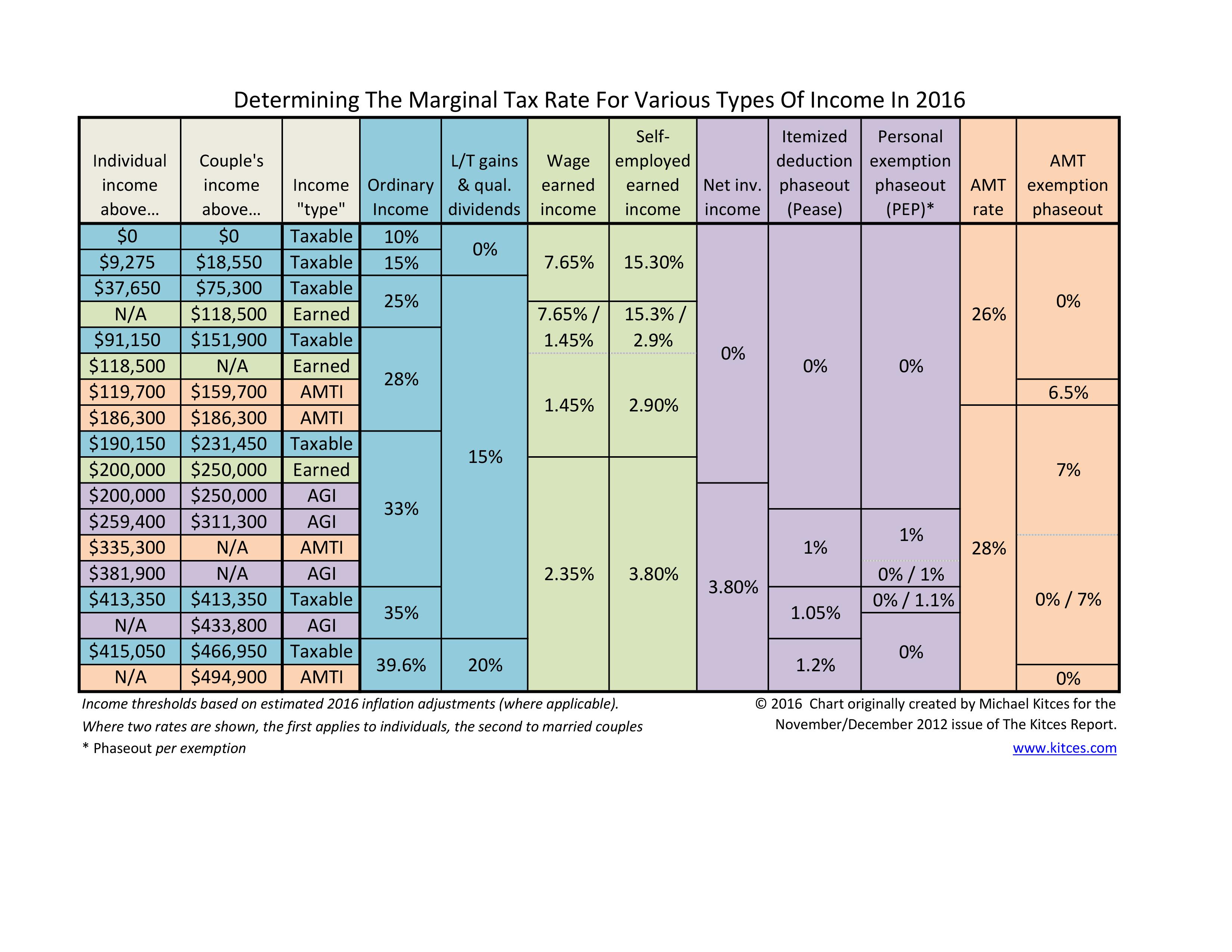

This would have meant that there would be a single 30% tax bracket for everyone earning between $45,000 and $200,000. This amount is the tax on taxable income before you take into account tax offsets.

Although these changes are several months away, understanding them now is crucial for effective financial planning.

Australia Marginal Tax Rates 2025 Printable Online, The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year. Set to take effect from 1 july 2025, the australian taxation office (ato) has announced significant amendments to the marginal tax rates.

New Tax Brackets 2025 Australia Vilma Jerrylee, We have now calculated our effective tax rate and marginal tax rate on our annual taxable income of $ 105,000.00 in australia for the 2025 tax year and can compare the results side by side: Please enter your salary into the annual salary field and click calculate.

Marginal Tax Rates Chart For 2025, The company is scheduled to release its q1 results on thursday, july 11, 2025. The 2025 financial year starts on 1 july 2025.

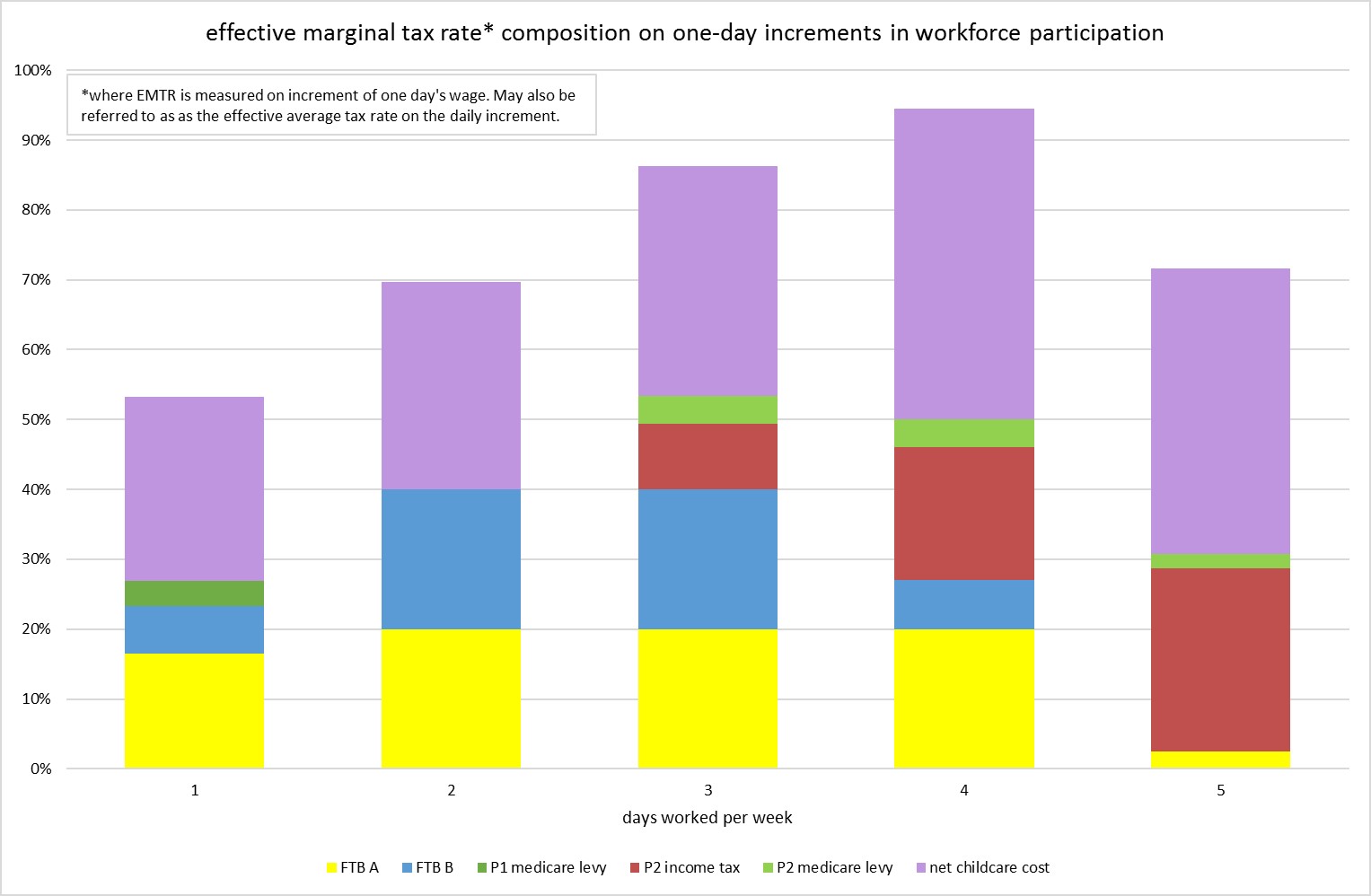

Figure8 Austaxpolicy The Tax and Transfer Policy Blog, Tax rates and thresholds summarised. Reduce the 19 per cent tax rate to 16 per cent.

Tax rates for the 2025 year of assessment Just One Lap, Knowing one’s effective and marginal tax rates in. Full salary after tax calculation for australia based on $ 2,024.00 annual salary and the 2025 income tax rates in australia.

Australia Marginal Tax Rates 2025 Printable Online, We have now calculated our effective tax rate and marginal tax rate on our annual taxable income of $ 20,000.00 in australia for the 2025 tax year and can compare the results side by side: The financial year for tax purposes for individuals starts on 1st july and ends on 30 june of the following year.

What are the Marginal Tax Rates in Australia? Mike Beal Financial, Tax rates and thresholds summarised. The income tax rates and personal allowances in australia are updated annually with new tax tables published for resident.

Marginal Tax Rates StreetFins, Foreign residents are not required to pay the medicare levy. The company is scheduled to release its q1 results on thursday, july 11, 2025.

2025 Tax Rates And Deductions For Seniors Debi Charleen, This downloadable excel tax calculator has been updated with the latest tax rates, including the tax reductions which come in on 1 july 2025. Welcome to the 2025 income tax calculator for australia which allows you to calculate income tax due, the effective tax rate and the marginal tax rate based on your taxable income in australia in 2025.

What Is My Tax Bracket 2025 Blue Chip Partners, These changes are now law. All income received by individuals is taxed at progressive tax rates in australia.